If you or your bookkeeper is just using the Write Checks window or the Register window to record a payment to the sales tax agency, you create a couple of errors in your books: You double-count sales tax expense, and you never show yourself paying off your sales tax liability.Īre You a Small-Business Owner Paying Too Much Tax? Note: the Washington State DOR has some additional useful information about when you have to file, and how often, here.Īnd a final important note: It’s really important to use the QuickBooks approach to record the remittance. If your business owes sales tax in Washington State, you can file your returns and actually pay the sales taxes you owe online here.

Basically, you choose the Vendors → Sales Tax → Pay Sales Tax command and select the sales tax agency you want to remit taxes to. And the process isn’t too terribly difficult. Intuit’s step-by-step instructions for recording a sales tax remittance are here. Step 3: Record the remittance in QuickBooks when you file your state sales tax return If you need help with figuring out whether you should enter a sale you make as an invoice or as a sales receipt, see our article explaining the difference here. If you’re a Washington State business and a buyer purchases your merchandise and walks away with it in your store, then the correct sales tax rate depends on your store address. This means that if you ship or deliver something to a customer, the sales tax rate depends on the shipping or delivery address. In Washington State we have “ destination-based sales tax” since 2008. The correct rate depends on local tax laws.

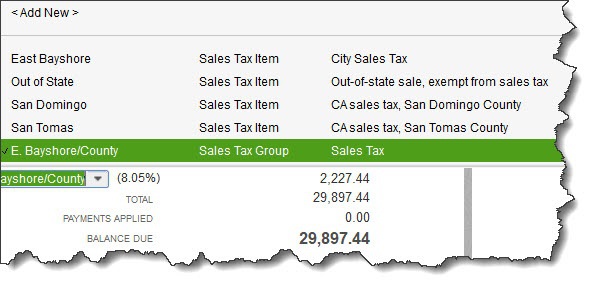

When you create the invoice or sales receipt, you’ll choose which tax rate item to apply from a drop down menu in the bottom right corner of the screen. But you need to be careful about one additional bit of information when you’re entering the transaction. You create a sales-tax laden invoice or sales receipt in the usual way when you work with QuickBooks. Step 2: Create the invoice or sales receipt for the sale The Department of Revenue website also answers a number of frequently asked questions about how our state sales tax works here and here. It lists the current rates for all local sales taxes here, as well as location codes for different sales tax jurisdictions.

It has a tool to help you look up which tax rate applies at a particular address here. Second, the Washington State Department of Revenue’s website has a number of helpful resources you can turn to when setting up and using sales tax items in QuickBooks. Note: the tax agency/vendor for both of these items will be the Washington Department of Revenue, since in Washington State the DOR collects all of the sales tax and then distributes it to the local governments. In this case, you probably want to have two sales tax items, one for Seattle with a rate of 9.5%, and one for Snoqualmie with a rate of 8.6%. To illustrate this with an example, let’s say that you sell your products in Seattle, which currently levies a local sales tax rate of 3%, and in Snoqualmie, which currently levies a local sales tax rate of 2.1%. Local governments can levy additional sales tax of up to 3%.) (As of this writing, Washington State sales tax is 6.5%. Intuit also has its own instructions here.īecause we operate in Washington State, let me provide two tips specific to Washington State.įirst, for a business in Washington State, you’ll probably want to set up a different sales tax item for each municipality where you do business. (The page says it provides instructions for QuickBooks 2012, but the instructions really work for any recent version of QuickBooks). Step-by-step instructions for creating a sales tax item are here. Specifically, you need take three steps: Step 1: Set up sales tax items in QuickBooks And you need to be confident that you can defend yourself in a sales tax audit.įortunately, QuickBooks makes calculating sales tax pretty easy if you take some time in the beginning to set things up right. You should make sure you remit the right amount to the state government. You need to show the right sales tax amount on customer or client invoices, of course. If you’re running a small business that sells items subject to sales tax, you want to do good accounting for sales tax.

#QUICKBOOKS PAY SALES TAX DOWNLOAD#

Download Your Free Copy of the Thirteen Word Retirement Plan.Five Minute Payroll Monograph (2019 Edition).Small Businesses and the Affordable Care Act (Obamacare).Preparing Form 3115 for the Tangible Property Regulations.Setting Low Salaries for S Corporations.

0 kommentar(er)

0 kommentar(er)